Changes to Due Dates Effective Now

In a bill for highway funding extension some provisions in the bill were what you would not expect, they were tax provision that changed due dates and additional requirements. The bill was signed into law by President Barack Obama on July 31, 2015. While the tax provisions are divided between new tax return due dates and clarification of previous tax laws. It is clear to see that legislators are starting to listen to the profession. As these changes are what the AICPA and other accounting societies have been trying to suggest would make it easier for preparers.

Changes to Form 1098 Mortgage Interest Statements

New information will start showing on Forms 1098, which many of you will recognize as the form that you turn in to your accountant. The form has information about your mortgage interest. These forms will require to provide more information such as the outstanding principal on the mortgage at the beginning of the year, the date the mortgage started and the address of the property that the information relates to. Certain companies have already started to add this information but does not become mandatory until 2017.

Consistent Reporting For Estate

Estate reporting will now require executor to furnish informational returns to the IRS and to any person receiving interest in property from the estate. Additionally it now adds a new law that requires inherited property cannot have a higher basis than what is reported by the estate. This is meant to curtail any confusion in basis as it has happened before. This change is effective for any estate tax return filed past the date of the new law.

6 Year Statute Of Limitations In Cases Of Overstatement Of Basis.

After the IRS lost in court back in 2012 due to the vague writing of a law in the case of U.S. v. Home Concrete & Supply, LLC. The Supreme court held that the IRS could not extend the statute of limitations to six years when it applied to matters of capital gains and overstatement of basis. Resulting in the taxpayer keeping the three year statute of limitation. The IRS decided to correct this mistake by making it clear that an overstatement in basis will be considered an omission from gross income and therefore they will be able to extend the statute of limitations to six years. This change applied to any returns that are filed after this new law becomes effective and also for any other returns that are still within the statute of limitations.

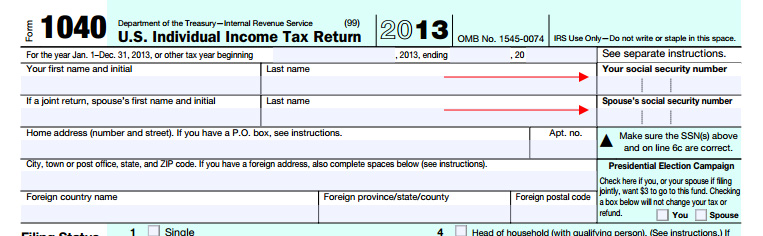

Modification to Tax Return Due Dates

- Partnership Tax Return will now be due March 15 previously these were due April 15, For fiscal year partnership they are due on the 15th day of the third month after their closing.

- C Corporations their new due date is 15th day of the fourth month after their closing. currently they are due on the third month

- FinCEN Report 114 is now due April 15 much earlier than previous deadline which was June 30. an Extension is now available.

- Corporations will be allowed a six month extension with different starting dates depending on if you are calendar or fiscal year corporation.

- Foreign trust reporting Form 3520-A Annual Information Return of a Foreign Trust with a United states Owner has been changed to the 15th day of the third month after closing.

- Form 3520 Annual Return to Report transactions with Foreign Trust with Receipt Of Certain Foreign Gifts has been changed to April 15.

- Due dates apply to taxable years beginning after December 31, 2015 with one exception C corporation with fiscal years have an extra ten years to make the change.

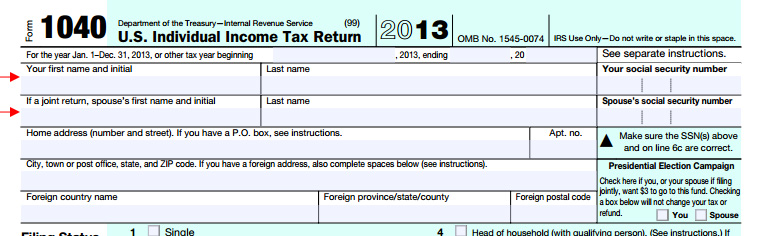

Modification to Extensions

- Form 1065: 6 Month Extension ending on September 15 for Calendar year taxpayers.

- Form 1041: 5 ½ Month period ending on September 30 dor calendar year taxpayer.

- Form 5500: Automatic 3 ½ month period ending on November 15 for calendar year plans

- Form 990: Automatic 6 month period ending on November 15 for calendar year

- Form 4720: Automatic 6 month period beginning on the due date for filing the return.

- Form 5227: Automatic 6 month period beginning on the due date for filing the return.

- Form 6069: Automatic 6 month period beginning on the due date for filing the return.

- Form 8870: Automatic 6 month period beginning on the due date for filing the return.

- Form 3520-A: 6 Month Extension

- Form 3520: 6 Month Extension

- FinCEN Report 114: 6 month period ending on October 15