Qualified Educator Expense Still Unchanged 11 Years Later

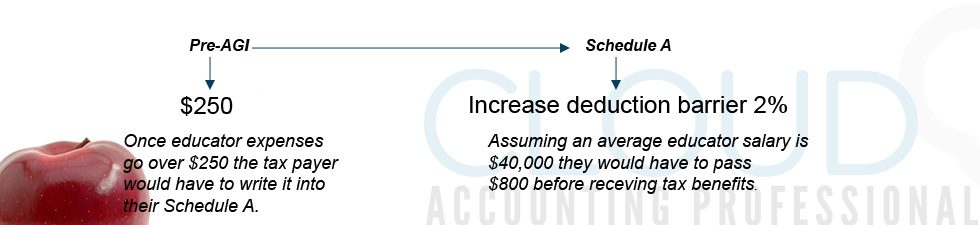

Since 2003, an eligible educator can take a Pre-AGI (adjusted gross income) deduction of up to $250. Although helpful, the rising cost of standard of living and inflation leaves our educators ignored.

(Latest annual inflation rate for the United States is 2.0%, as reported by the Bureau of Labor Statistics)

It’s time for that to change; educators should receive more benefits during tax time. Educators use these funds on items such as books, school supplies, and even software which is paid out-of-pocket to ensure their students have all the materials they need to learn and master their craft.

(In some states, home schools are considered private schools by case law and statute.)

Any expenses educators incur past the original $250 can be deducted towards their AGI, but the problem is they are entered as a Miscellaneous Business Expense, which is hindered by the 2% limitation.This meansif they haven’t reached the limitation, they won’t benefit from their contribution to a student’s learning, and if they have, their contributions will be limited.

Who qualifies?

- You are a kindergarten through grade 12:

-Teacher

-Instructor

-Counselor

-Principal

-Aide

- You work at least 900 hours a school year in a school that provides elementary or secondary education, as determined under state law.

Benefits:

- An Increase to Educator Expense would assist our educators financially.

- Benefits would trickle down to students as more learning materials are provided to them.

- It will give us clear understanding of the burden we place on our educators.

- More incentive for teacher to remain in their profession and give a better experience to students

Sources:

Inflation: http://www.bls.gov/

Qualifications: http://www.irs.gov/taxtopics/tc458.html